On this page

Manage your account

My account

Card services OpenClose

Activate your card

How to activate your card

If you're new to Royal Bank of Scotland, we'll post your Mastercard debit card and PIN separately within a few days of opening your account. Once your card arrives we'll explain how to activate it.

If you're already a Royal Bank of Scotland customer and have recently changed your account, there's no need to activate. You get to keep your existing card and PIN.

Request a contactless debit card

You will receive a contactless debit card as standard when your existing card requires replacing, or if you're a new customer at account opening.

If your existing card is not contactless, you can request a new card, giving you a quick and simple way to make purchases. Retailer limits apply.

Freeze or use payment controls to protect your card

How to freeze or use payment controls to protect your card

Freeze your card

If you've misplaced your debit card, or want to stop it from being used, you can temporarily freeze your card to protect it from unauthorised use. You can freeze and unfreeze your card at any time using your mobile app.

Card payment controls

Use the mobile app to simply switch on payment controls to stop your card making certain types of payments:

- Chip & PIN

- Contactless

- Online and telephone

- International In-person

- Gambling merchants

You can instantly switch these back off at any time in the app.

Report your card lost or stolen

How to report your card as lost or stolen

If you think your debit card or any of your card details, such as your PIN may have been stolen, you should report it to us to avoid the possibility of fraud.

You can now instantly report your card as lost, stolen or damaged through your mobile app. Simply open the app, tap on the account that your card is linked to and select 'Manage my card' to see your options.

You can also report your card by logging in to Digital Banking.

Alternatively, you should call us as soon as possible on:

UK: 0370 600 0459 | Relay UK: 18001 370 600 0459

Overseas: +44 1268 500 813

Once you’ve reported your debit card as stolen, we will send out your new card which will be with you in five working days.

Order a card reader

How do I order a new, replacement or additional card-reader?

If you have not yet ordered a card reader or your card reader is lost, damaged or out of battery power, you can order a new one in Digital Banking. Your replacement will arrive in 3-5 working days.

- Log in to your Digital Banking service at www.digitalbanking.rbs.co.uk

- Select 'Security' from the menu in the 'Using a card reader' section.

- Select 'Order a card reader'.

What is an accessible debit card?

All our debit cards are accessible

Our accessible card is available on all Royal Bank of Scotland current accounts. It is developed with and accredited by the Royal National Institute of Blind People, so it's easier to use your card if you are blind or partially sighted.

Our cards are issued with flat print numbers. If you require a braille plastic wallet, please call us at 03457 888 444 (Relay UK – 18001 3457 888 444) for further details.

If you require braille, large print or audio fulfillment please fill in the form below.

Request braille, large print or audio fulfilment

Your new Debit Mastercard

Your new Debit Mastercard

We’re switching to Mastercard and all our customers will receive a replacement card in new designs. Please visit our dedicated webpage to find out more.

My account OpenClose

Change your address

How to change your address

Mobile Banking is the quickest way or you can use Digital Banking, write to us or visit a branch instead.

Registered for the mobile app? The easiest way is to navigate to your My Profile page (using the person icon on the top right, and click on manage your personal details). Where you will have the option to edit your address, and follow the on-screen instructions.

Registered for Digital Banking?

- Log in to Digital Banking.

- Select 'Your Details' from the left-hand menu.

- Choose from one of the on-screen options.

Please note that if you wish to update your address details, our website will give you options to start a chat with one of our agents, give us a call or visit a branch. Please remember to take some form of photographic identification, such as your passport or driving licence with you, along with your active Debit Card and PIN if visiting a branch.

If you use our Mobile Banking app, you can also request a change to your address when on the go via our 'Message Us' feature. Simply select 'Help' when logged in, and then choose 'Message Us'.

Not registered for Digital Banking?

You can change your address in writing by sending us a signed request addressed to a branch. This can be posted to a branch. Alternatively you can visit any Royal Bank of Scotland branch - Please remember to take some form of photographic identification, such as your passport or driving licence with you, along with your active Debit Card and PIN. Find your nearest branch using our branch locator.

Dispute a debit card transaction

Want to dispute a debit card transaction?

If something's not quite right with a purchase you recently made with your debit card, we may be able to help you get your money back.

The first step in making a claim is speaking to the retailer to see if they can resolve the issue for you. If you have contacted the retailer and they were unable to assist, we can raise a dispute for you.

Order a copy statement

How to order a copy statement

If you want paper copies of your online statements for your current account, savings accounts or credit card, you can save and print PDF versions from your Online Banking.

You will get an email when your most recent statement is available.

For help with printing paper statements, you can follow the step-by-step instructions.

- Log in to Digital Banking.

- Select 'Statements' from the main menu and then 'View, save and print PDF statements and certificates of interest (up to 7 years)' from the 'Your accounts' section.

- Select the account you want the statement for, and then 'Next'.

- From the list of available statements select the one you need to print, and then 'View Statement'.

- Select 'Download Statement (PDF)' at the start of the page.

Want a copy posted to you?

If you find you can't print a PDF statement by following these instructions, or don't have access to a printer, you can chat to our Digital Banking helpdesk.

Check my balance

Check your balance on the go

You can check your balance on the go by logging in to our mobile app.

Alternative log in to Digital Banking where you can view your balance and statements, make payments, transfers and more to help manage your account.

Overdrafts OpenClose

Arranged overdrafts

Arranged overdrafts

If payday is still a long way off and things are a bit tight, an arranged overdraft could act as a short-term safety net.

Representative 39.49% APR (variable) .

How does our overdraft compare?

A good way to compare the costs of borrowing products is by using the APR, which shows the cost of borrowing over a year.

To apply, you must be a UK resident, 18+ and have an eligible Royal Bank of Scotland current account. Subject to approval.

Payments OpenClose

Set up, change or cancel a Direct Debit

How to set up, view or cancel a Direct Debit

Manage your Direct Debits

A Direct Debit is an agreement between you and the organisation you’re paying, which allows the organisation you want to pay to collect varying amounts from your account – but only if you’ve been given advanced notice of the amounts and dates of collection.

View or cancel a Direct Debit

You can easily view or cancel a Direct Debit via our mobile app or through your Digital Banking.

While you can’t set up a Direct Debit without the input of the people you are paying, you can view and cancel your Direct Debit directly with us.

You have up until 8.20pm (UK time) on the day the payment is due to cancel.

Make a transfer or payment

How to make a transfer or payment

You can make payments or transfers on the go by logging in to our mobile app. Using your mobile app you can:

- Pay someone new* up to £1000 without a card reader.

- Pay saved payees, up to £20,000.

- Create, amend and cancel regular payments.

*There is a maximum of 5 payments totalling £1000 per day. You must be aged 16 or over.

Alternatively log in to Digital Banking where you can view your balance and statements, make payments, transfers and more to help manage your account.

Need more help?

See our dedicated page to find out more about making payments.

Make an international payment

How to make an international payment

You can make international payments quickly and safely using our mobile app or Digital Banking.

- We don’t charge a fee to send standard international payments using digital banking or the mobile app.

- Live rates, so that you know exactly how much you will pay when making a transaction.

Please be aware, the recipient bank may charge fees for international payments.

Account terms OpenClose

Current account terms, rates and charges

Current account terms, rates and charges

We want to ensure that everyone is aware of their account terms, rates and charges so we've gathered all the important information for your Royal Bank of Scotland current account in one place.

Debit card user guides

Your debit card user guides

All you need to know about your accessible Visa or Mastercard Debit card with contactless.

Accessible Visa Debit card with contactless User Guide (PDF, 82 KB)

Accessible Debit Mastercard with contactless User Guide (PDF, 193 KB)

All you need to know about your accessible Visa Debit card.

Accessible Visa Debit card User Guide (PDF, 78 KB)

All you need to know about your Savings Account card.

Savings Account Card (PDF, 141 KB)

Make the most of your Premier Mastercard. Simply choose your Premier account to see your benefits.

Premier accounts

Financial support OpenClose

Help managing your money

Managing your money

Take a look at our guides on budgeting, saving and dealing with debt. We have guides and tools to help you review and improve your credit score, get help if you're struggling financially, and reduce your household bills.

Explore your account and benefits

To view any benefits and get the most out of your current account, simply pick the account you have with us.

Student, Graduate and Youth

MyRewards

Access your MyRewards account, view your personalised offers and redeem your Rewards.

Make a change to your account

To upgrade or switch you need to be an existing Royal Bank of Scotland current account customer.

Switch to Royal Bank of Scotland

Switch a current account held elsewhere to your existing account using the Current Account Switch Service.

Current Account Switch Guarantee Logo

Current Account Switch Guarantee Logo Upgrade or change my account

If you'd prefer one of our other accounts, you can change your account online. It's quick and easy to change.

If you're not sure which account to change to, you can explore our current account range.

You need to be a current account holder, 18+ and a UK resident. If you're a non-UK resident, once your account has changed to a Select account you'll be unable to upgrade to any Reward accounts. Specific account eligibility and monthly fees may apply.

Make a change to your account

You can set up a joint bank account with a range of our savings and current account products, excluding Student and children's accounts.

We could also help you to make other changes to your account:

- Add or remove an account holder

- Add a third party cardholder

- Add a Power of Attorney

- Add a Court of Protection/Scottish Financial Guardianship

Make banking simple with our mobile app

Check your credit score for free

Get on top of your finances by regularly monitoring your credit score in our app.

Available once opted in through the app to customers aged 18+ with a UK address and is provided by TransUnion.

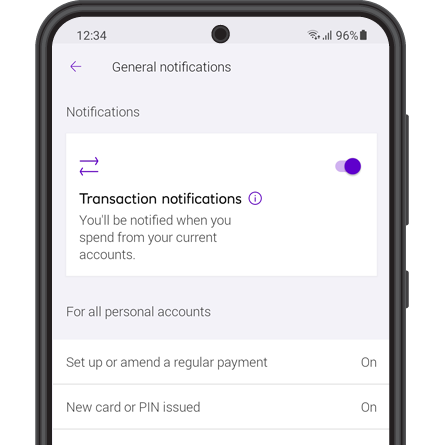

Approve a transaction

If you've got your notifications turned on, you can tap the notification to go straight to your app. Otherwise, log in to your app and tap the 'Approve a transaction' tab at the top of the home screen.

Save your spare change with Round Ups

Pay with your debit card and we'll round up the amount to the nearest pound, then send the spare change to your savings account.

Save little and often and the pennies soon add up. Eligibility criteria and limits apply.

Our app is available to personal and business banking customers aged 11+ using compatible iOS and Android devices. You'll need a UK or international mobile number in specific countries.