Switch a bank account to our Select account and you could get our £175 Switch offer. Offer T&Cs apply.

To apply, you need to be 18+ and a UK resident.

2. Within 60 days of switching

Pay in £1,250

This can be made of multiple payments and must remain in the account for 24 hours.

Log in to our mobile app

This can be done on any device that supports the Royal Bank mobile banking app.

Fancy an extra £50?

Here's how it works:

Open a Digital Regular Saver (DRS) within 60 days of completing your switch to us. Once you receive your £125, we'll then add another £50 to your DRS within 30 days.

Total earned? £175!

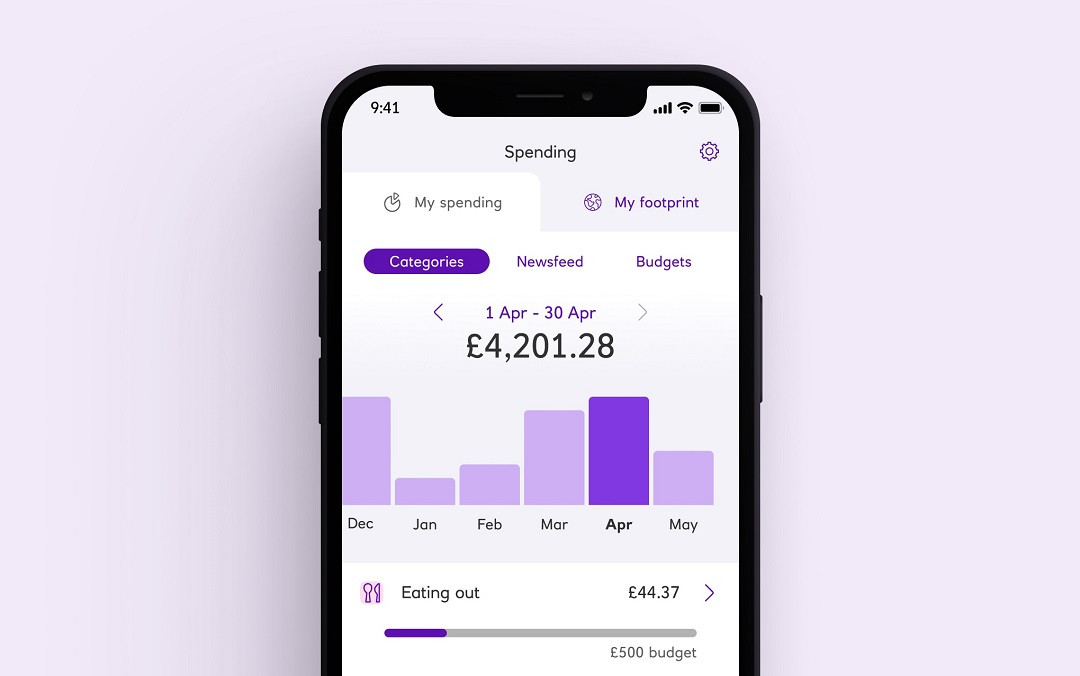

Mobile banking screen showing budgeting activity

Mobile banking screen showing budgeting activity Budget better, spend less

Spending will put your transactions in to categories, giving you a detailed view of where your money is going.

Available to customers aged 16+ who hold a Personal or Premier current account.

Mobile banking screen for viewing Credit Score

Mobile banking screen for viewing Credit Score Know your score

With our mobile app you can keep up to date with your credit score for free.

Available to customers aged 18+, with a UK address and is provided by TransUnion.

Mobile banking screen for Open Banking

Mobile banking screen for Open Banking View your accounts with other banks

View balances and transactions on selected accounts with participating UK banks. All your money on one screen.

You need to be registered for online banking with your other banks.

Overdraft details

How to open a bank account online

Everyday current account – Frequently asked questions

If you carry on applying, it means you're happy with what's in these documents, including the FSCS information sheet. And happy to view your statements in Digital Banking - not posted. Please take some time to review, print and/or save the important information.