To be eligible for Tyl by NatWest your business must be based and trading in the UK, and you must be over 18. Eligibility criteria, fee's and T&Cs apply.

6 months free card machine hire**

Did you know we now offer 6 months free card machine hire fees** when your business takes more than £100k in card payments per year?

*New Tyl by NatWest customers who take more than £100k in payments a year only. This will be based on the estimated annual payment value provided by the customer. We reserve the right to reclaim the promotion value should the customer take less than £100k in payment in their first year with Tyl By NatWest. Promotion valid from 1st February 2025 to 31st May 2025. Minimum 12-month contract. After 6 months standard hire fees per device will apply. Additional fees may apply for data usage or app downloads. Early cancellation fees may apply, eligibility criteria and fees apply.

Get in touch with our friendly team on 0161 605 6626 (Using Text Relay UK? - Add 18001 before any of our phone numbers) to find out how we could help you or leave your details using the link below.

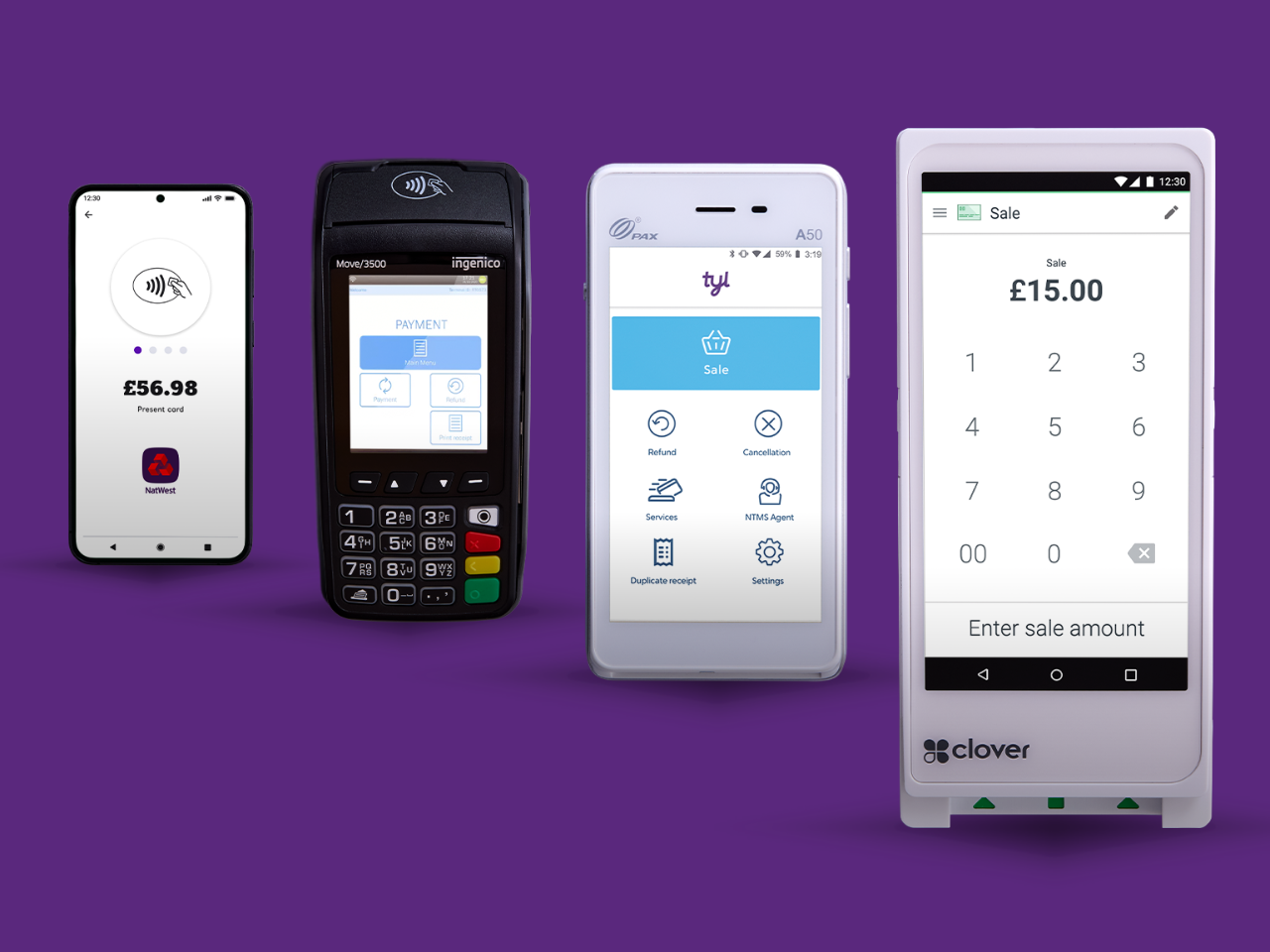

Take payments in person

Choose any card machine and pay no hire fees for 6 months*, or take fast, contactless payments with your smartphone and NatWest’s Tap to Pay app.

Online payments

With our Payment Gateway, you can add an online shopping cart to your website or send customers direct payment links. We’ll even help you with the branding.

Phone payments

We can help you take payments and manage personal data, while you have a customer on the phone, using our secure webpage.

*New Tyl by NatWest customers who take more than £100k in payments a year only. This will be based on the estimated annual payment value provided by the customer. We reserve the right to reclaim the promotion value should the customer take less than £100k in payment in their first year with Tyl By NatWest. Promotion valid from 1st February 2025 to 31st May 2025. Minimum 12-month contract. After 6 months standard hire fees per device will apply. Additional fees may apply for data usage or app downloads. Early cancellation fees may apply, eligibility criteria and fees apply.

*New Tyl by NatWest customers who take more than £100k in payments a year only. This will be based on the estimated annual payment value provided by the customer. We reserve the right to reclaim the promotion value should the customer take less than £100k in payment in their first year with Tyl By NatWest. Promotion valid from 1st February 2025 to 31st May 2025. Minimum 12-month contract. After 6 months standard hire fees per device will apply. Additional fees may apply for data usage or app downloads. Early cancellation fees may apply, eligibility criteria and fees apply.

Other services you might like

Send and collect money on your RBS app with Payit™

Split bills and request payments from anyone who uses mobile banking and has an eligible account with a participating UK bank (eligibility criteria and limits apply).