This rate is available on loans between £7,500 and £14,950. Other loan amounts are available at alternative rates. Our rates depend on your circumstances, loan amount and term and may differ from the Representative APR.

To apply, you must be 18+ and a UK resident with a Royal Bank of Scotland current account (held for 3+ months)

Get a quote with no impact on your credit score

If you have a Royal Bank of Scotland current account and you're looking for a sole loan, in most cases we’ll confirm the loan amount and rate at the start of your application with no impact on your credit score.

Apply in minutes

It can take as little as 10 minutes to apply for a Royal Bank of Scotland loan online. We'll ask you to log in to Digital Banking so have your details handy. We will also pre-fill some of your details to make the journey easier.

Get your money on the same day

You could get your loan funds on the same day if you apply online before 5.45pm Monday to Friday (excluding bank holidays). Sometimes we may need to contact you for a little more information, so it can take a little longer.

Highly rated by independent bodies

We've been independently rated 5 stars for our 'Unsecured Personal Loan' by:

- Moneyfacts in 2021, 2022, 2023 and 2024.

- Defaqto in 2021, 2022, 2023 and 2024.

How long could you borrow for?

Loan calculator

Representative Example:

£7,500

0 months

£137.55

£8,253.00

3.9

% APR

3.9

%

The rate you pay depends on your circumstances, loan amount and term and may differ from the Representative APR. We will never offer you a rate exceeding 29.9% p.a. (fixed), regardless of loan size. This means you're not guaranteed to get the rate you see in the calculator.

Get your free personalised quote

Find out if we’re likely to say ‘yes’ before you apply – and how much your personal loan might be.

Don’t worry, a quote takes minutes and won’t affect your credit score.

Could a different loan amount cut your interest rate?

A small change in the size of your loan could make a big difference to the total interest you pay.

That’s because the interest rate depends not just on your circumstances, but on how much you borrow.

So, what’s the best loan rate you could get from us? Have a play with our loan calculator.

(Remember, only borrow what you need.)

You can borrow for more than one purpose on the same loan. For example should you be looking to consolidate debt and do some home improvements you can do this under the one loan application. Your loan purpose should be selected as the purpose that will make up at least 50% of the borrowing purpose. Should you be borrowing for multiple purposes and no element makes up more than 50% of the borrowing then the loan purpose should be your largest expenditure of the funds.

Buy a car

Improve home

Consolidate debt

Get married

Go on holiday

Joint personal loans

Work together to get where you need to be with a joint loan

- Borrow money with someone close, such as a relative, partner or friend

- You could use the money for a shared project or special event

- Work at repaying the loan together

Already have a loan with us?

Top up an existing loan

If you already have a loan with us but need to borrow more, we may be able to help.

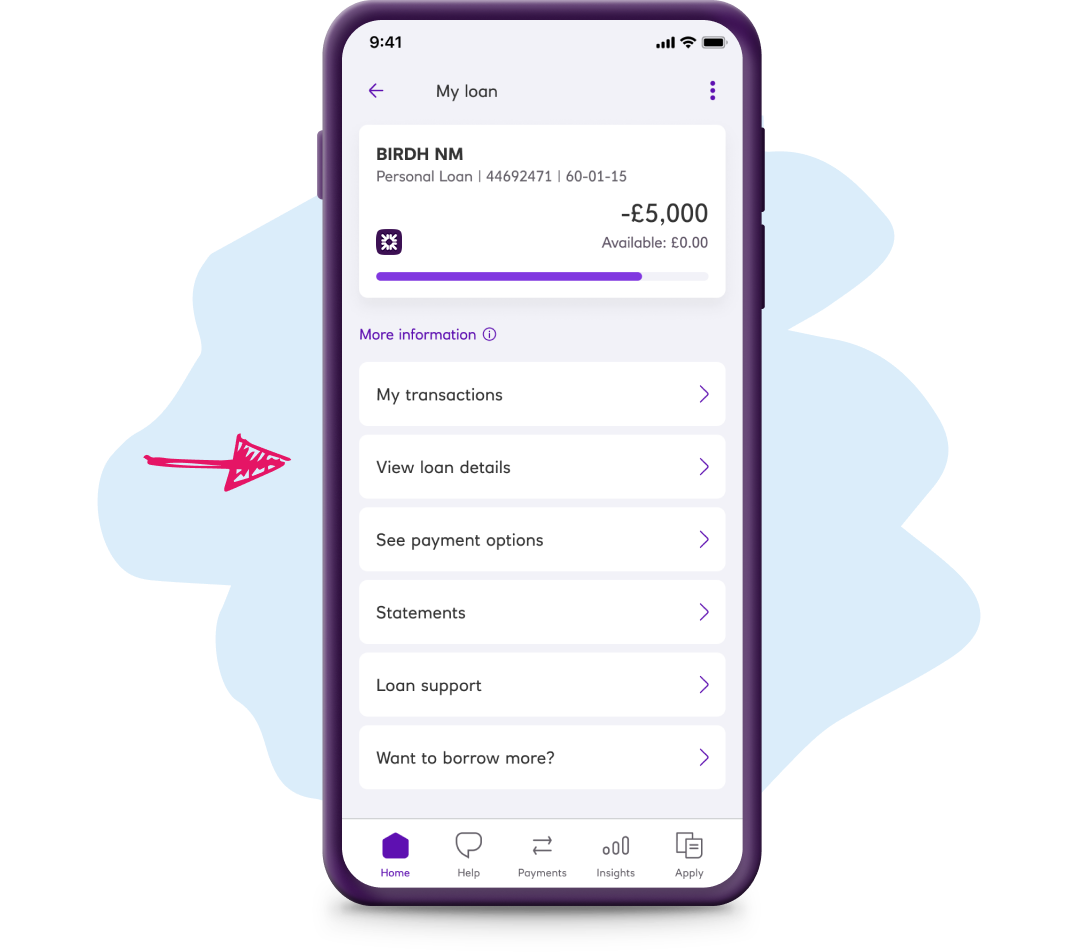

Manage your existing loan

Manage your loan online and find out more about making extra payment, paying off your loan, and more.

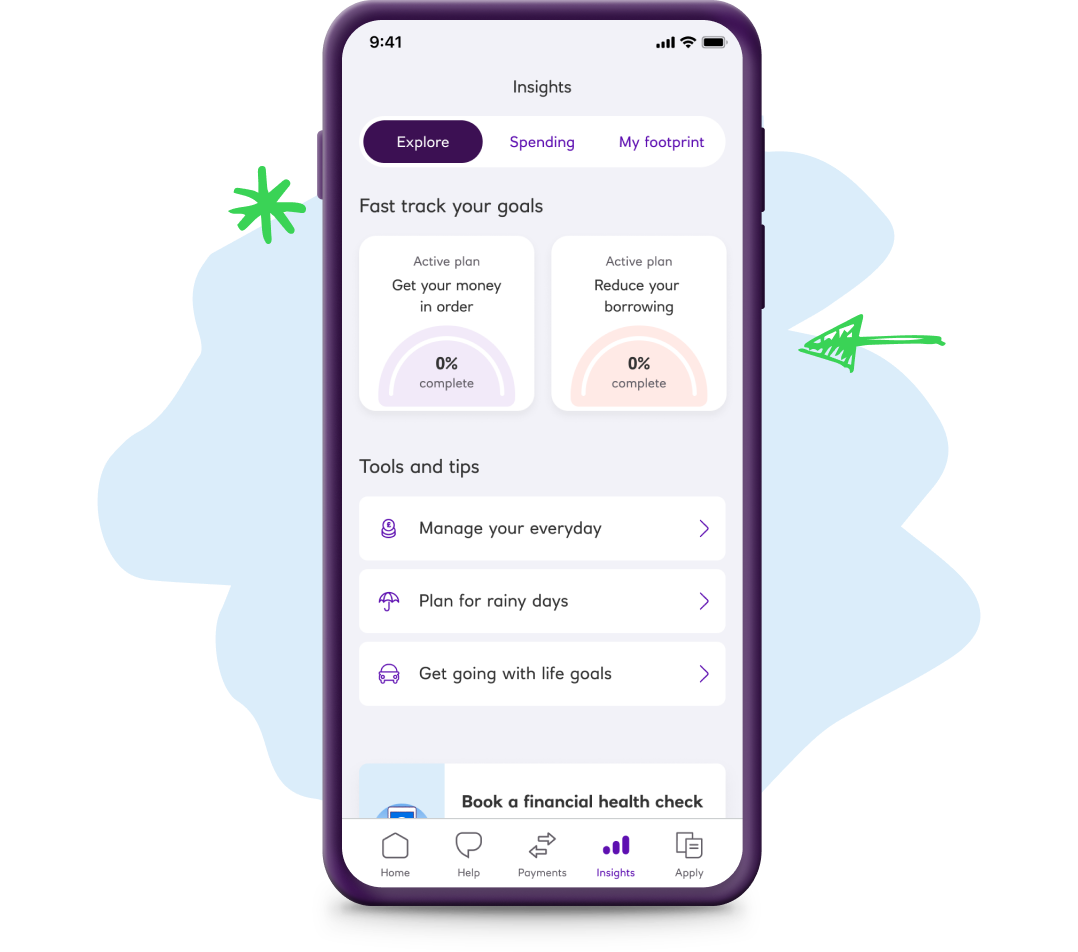

It's easy to manage your loan

We make it easy to manage your loan, so you're in control:

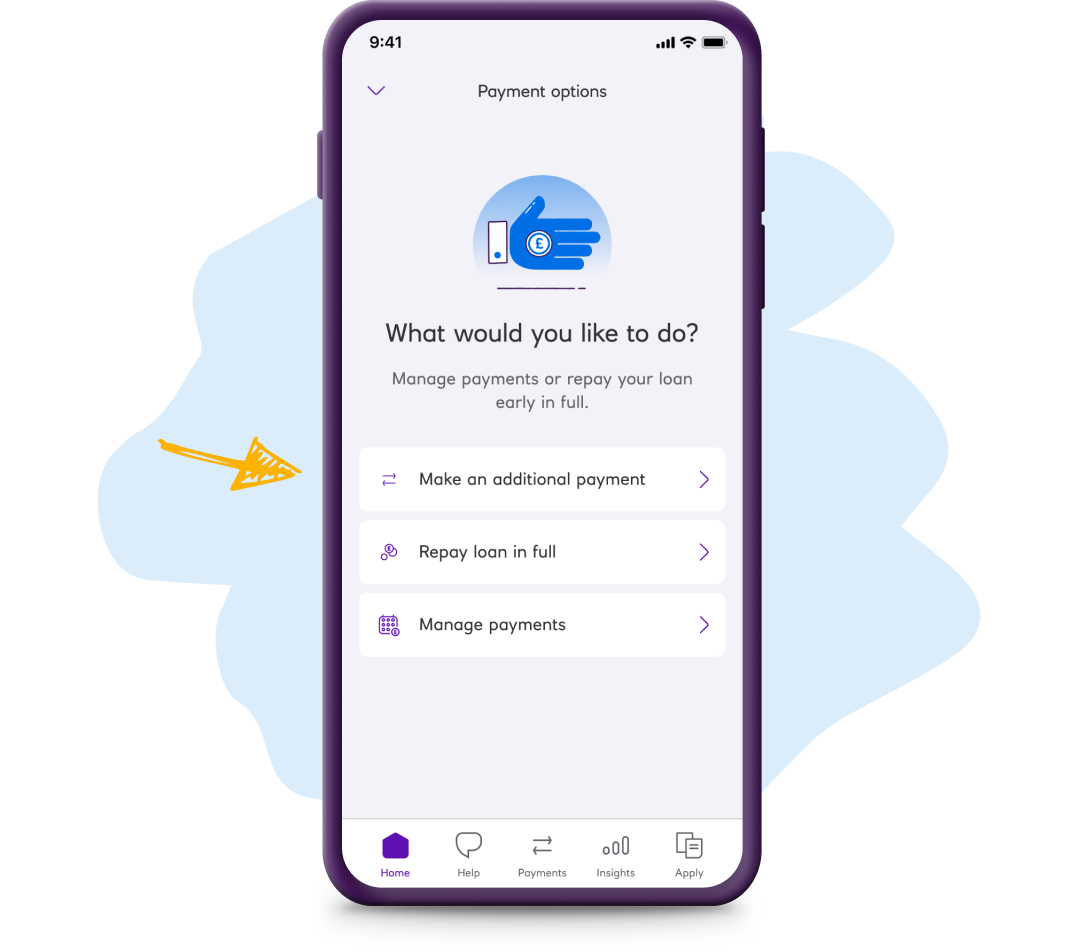

Pay us back early, if you want

You'll just need to pay a fee.

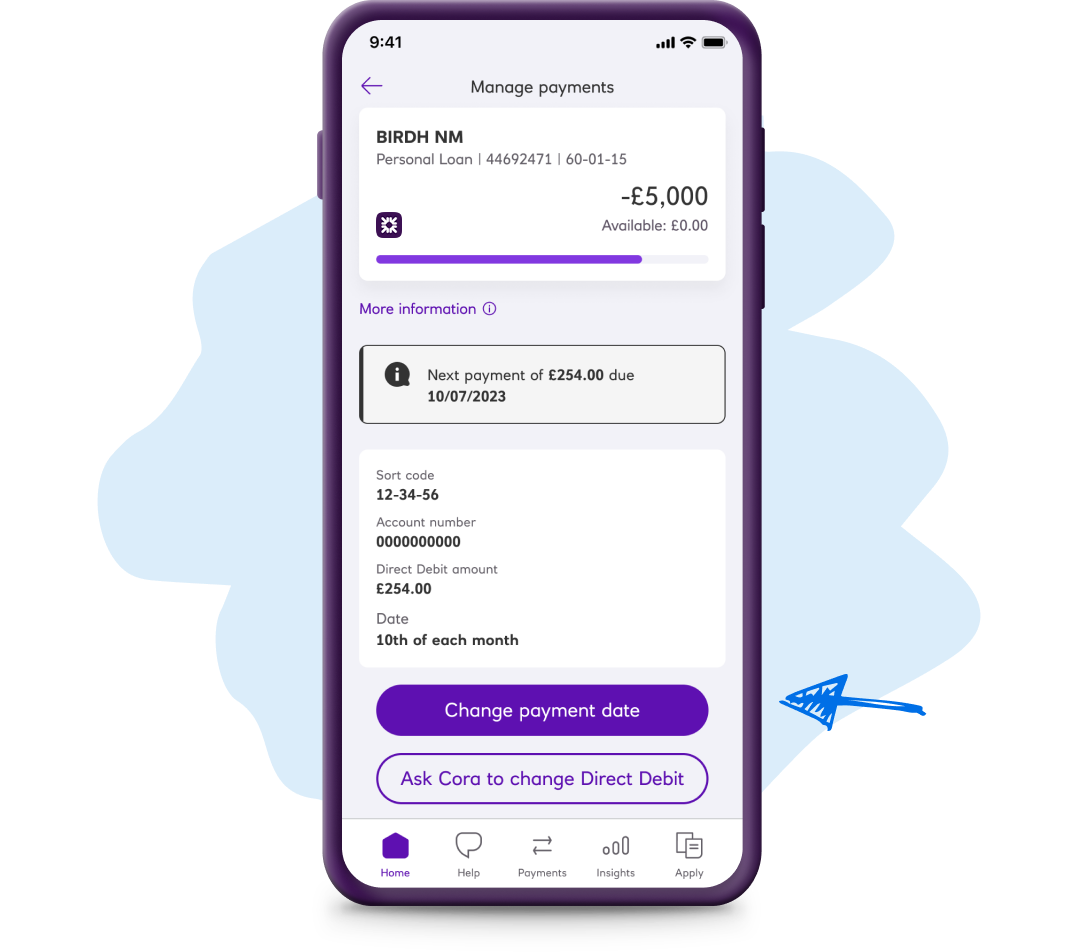

Make overpayments

Chip away at your balance as and when you can.

Use our quick and simple app

Everything you need in one place.

Change your payment date

Just give us a call and we’ll update your Direct Debit.

It's easy to manage your loan

We make it easy to manage your loan, so you're in control:

Can I pay off my loan early?

It’s important to remember that if you repay your loan early, you will be charged an Early Repayment Fee. The amount you will be charged will be equal to 58 days’ interest on the amount you repay early (28 days’ interest if the period of the Loan is one year or less). If there is less than 58 days (or 28 days if applicable) remaining on the loan, the calculation will be based on the actual number of days remaining. This is in addition to your outstanding loan amount and any outstanding interest.