Spend your holiday euros or US dollars like a local.

Your holiday spending pot...

With Travel account, you can create a euro or US dollar holiday spending pot to use abroad with your existing physical or virtual debit cards, without any fees from us.

You can open a Travel account for free in our mobile app.

Available to existing sole account holders of eligible current accounts who are registered for mobile banking and are UK residents over 18. Limited to two Travel accounts per customer, one for euro and one for US dollar.

-

✔

Spend like a local in euro or US dollar, with no fees on purchases from us. Track your euro or US dollar spending in the app to help you budget your holiday pot.

-

✔

We won't charge you a fee for the first €200 or $200 you withdraw in cash from ATMs every 30 days. Local ATM fees may apply.

-

✔

Top up in app, 24/7. You can exchange pounds from your current account into your Travel account at any time and exchange back again too once you're home.

-

✔

Easy set up. Open and use a Travel account in the mobile app within minutes.

How Travel account works

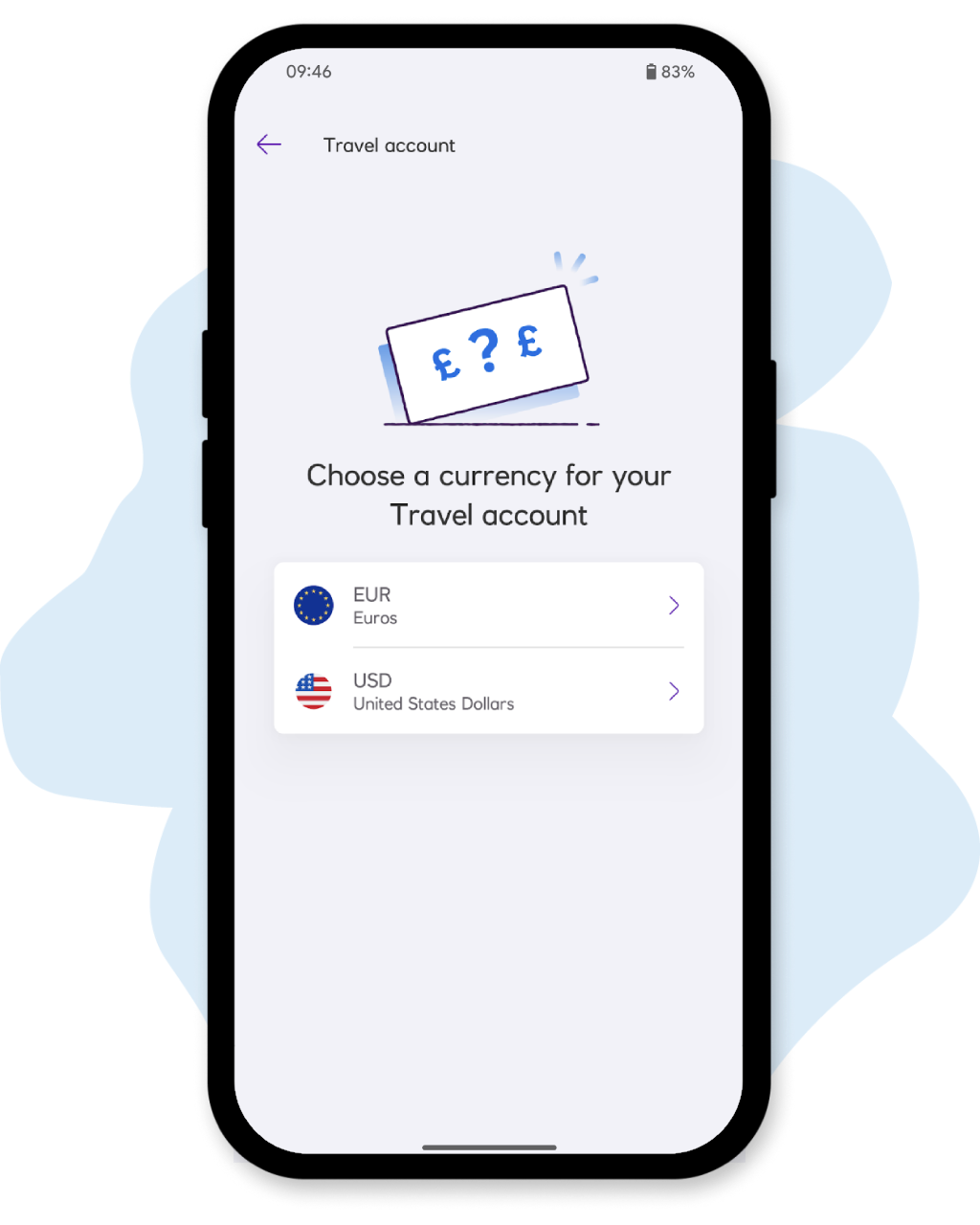

Choose a currency

Simply select the currency you’d like to use to get started. Want both? You can open two Travel accounts, one for each available currency.

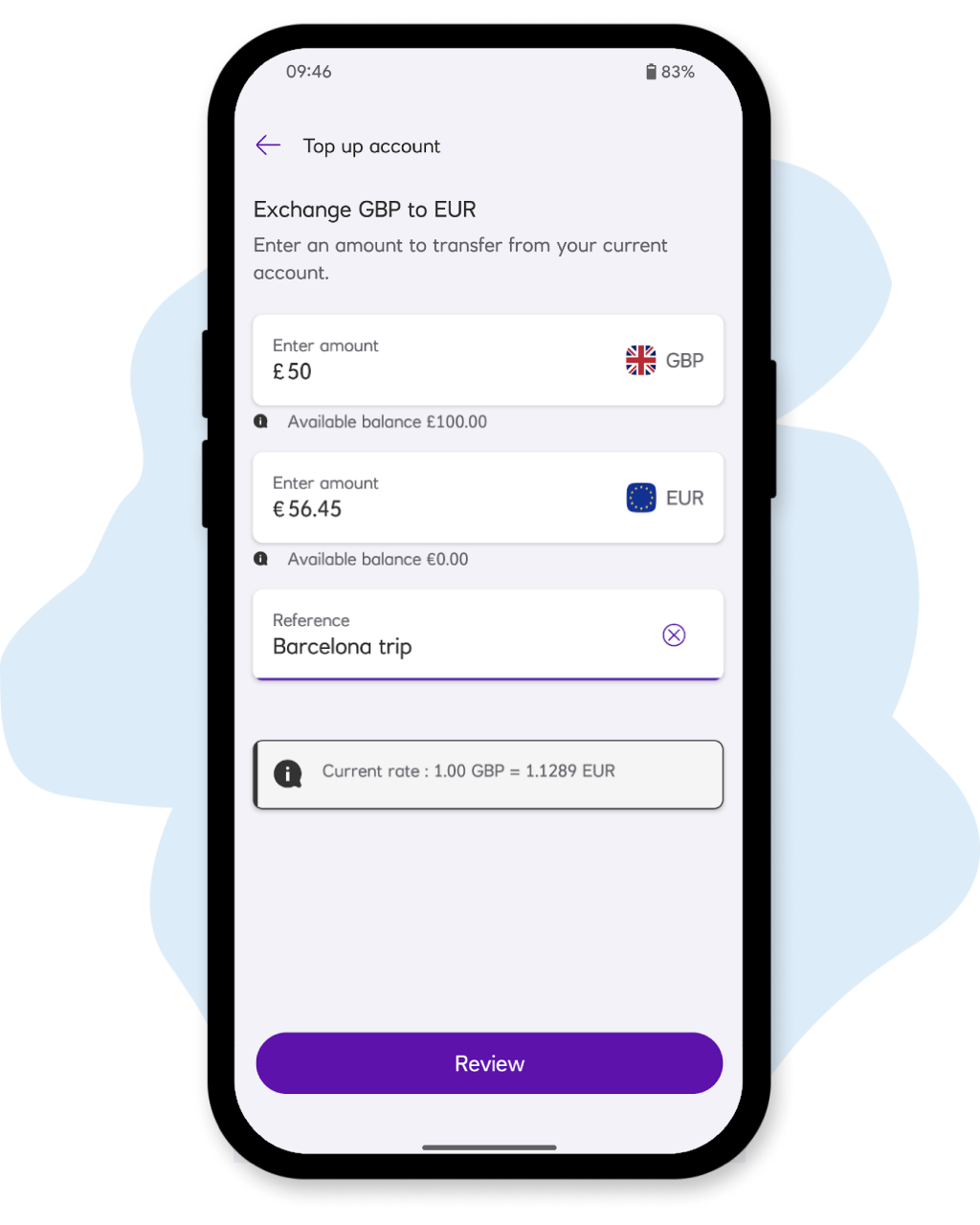

Top up your Travel account

Enter the amount you’d like to add, tap ‘Review’ to check the details, and you’re good to go. Your currency is ready to spend right away!

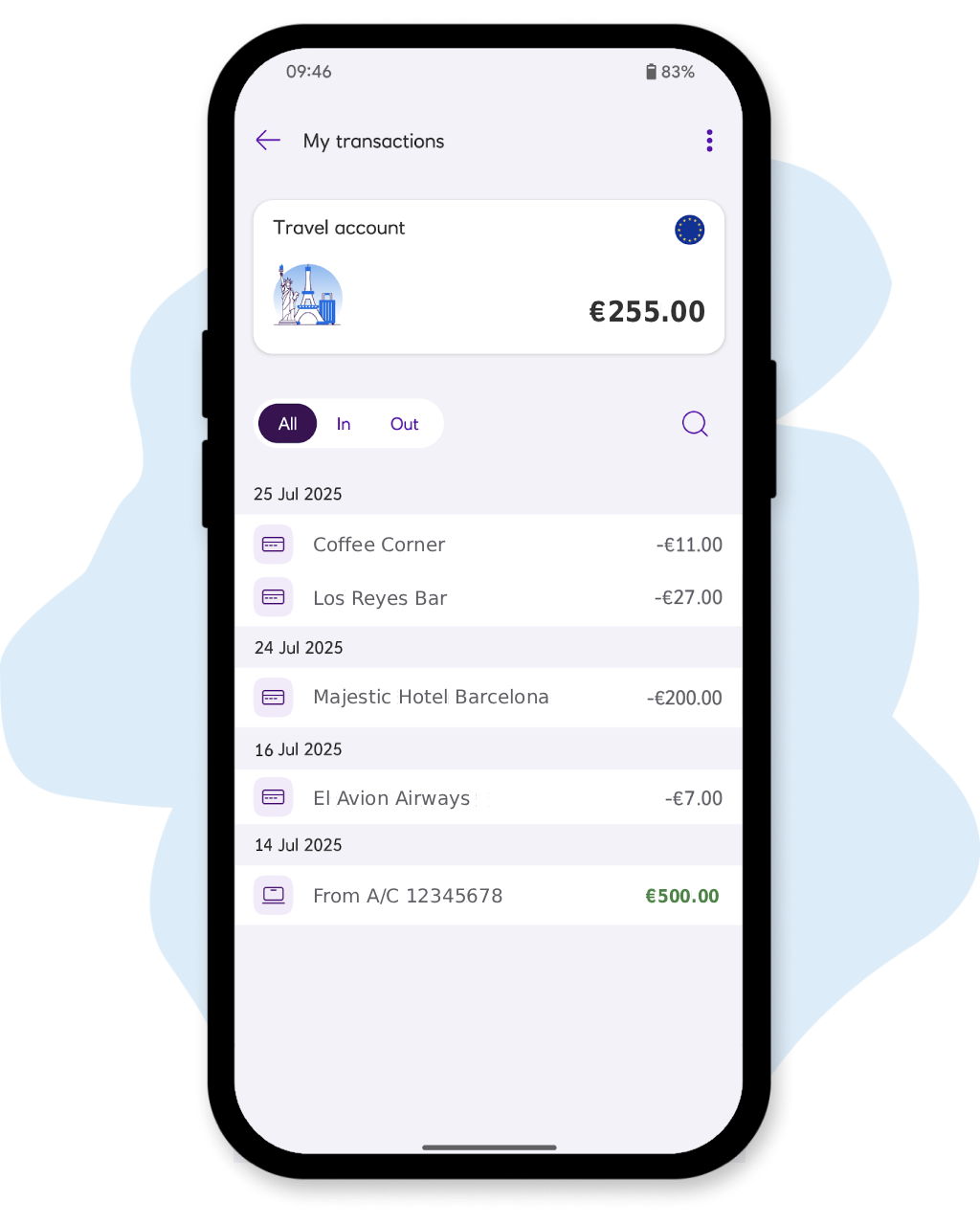

Keep track of your spending

View all your Travel account transactions separately from your current account right in the app to stay on top of your spending.

How Travel account works

Ready to set up?

It looks like you're not on your phone at the moment.

If you already hold an eligible Royal Bank current account and want to add a Travel account, simply scan this QR code with your mobile phone's camera and we'll take you right to where you can get started in the app (help! I can't see the Travel account option).

Ready to set up?

Thinking about opening a Travel account?

If you already hold an eligible Royal Bank current account and want to add a Travel account, just tap the link below and we’ll take you right to where you can get started in the app (help! I can't see the Travel account option).

Ready to set up?

Thinking about opening a Travel account?

If you already hold an eligible Royal Bank current account and want to add a Travel account, just tap the link below and we’ll take you right to where you can get started in the app (help! I can't see the Travel account option).

Pay with your debit card in euro or US dollar with no fees from us

To use a Travel account, make sure you choose to pay in the local currency, not pounds, at a card terminal.

You can use your physical debit card or a digital wallet, like Apple Pay or Google Pay, with a Travel account.

If you run out of euros or US dollar, we will take the full transaction amount from your linked current account and fees may apply.

Withdraw up to €/$200 abroad every 30 days with no fees from us

You can withdraw more, but it will come from your linked current account and we'll charge our usual fee to withdraw cash abroad.

Remember to select euros or US dollar, not pounds, at an ATM to secure fee-free cash.

Local ATMs may charge their own fees.

Online shopping in euros and US dollars

Buying something online in euros or US dollars? Enjoy fee-free spend by using your Travel account with your linked debit card.

Some merchants may charge additional transaction fees online. If you run out of euro or US dollar, we will take the full amount from your linked current account instead and fees may apply.

Important Documents

Royal Bank of Scotland Privacy Notice is available here.

The money in your Travel account is protected as part of the FSCS scheme.

Already enjoy no foreign transaction fees on purchases abroad with a packaged account?

If you have a Reward Silver, Reward Platinum, Premier Reward Black or Black Account, you already enjoy no foreign transaction fees when spending on your debit card abroad, while ATM cash withdrawals carry a 2.75% fee.

If you would prefer the peace of mind of purchasing euro or US dollar in your app ahead of your trip, at the provided exchange rate at the time, then Travel account could still be a good option for you.

With a Travel account you could also benefit from fee-free ATM cash withdrawals of up to €/$200 every 30 days. Further withdrawals will be charged to the linked current account, and a 2.75% fee will apply.

Monthly account fees and eligibility criteria apply.