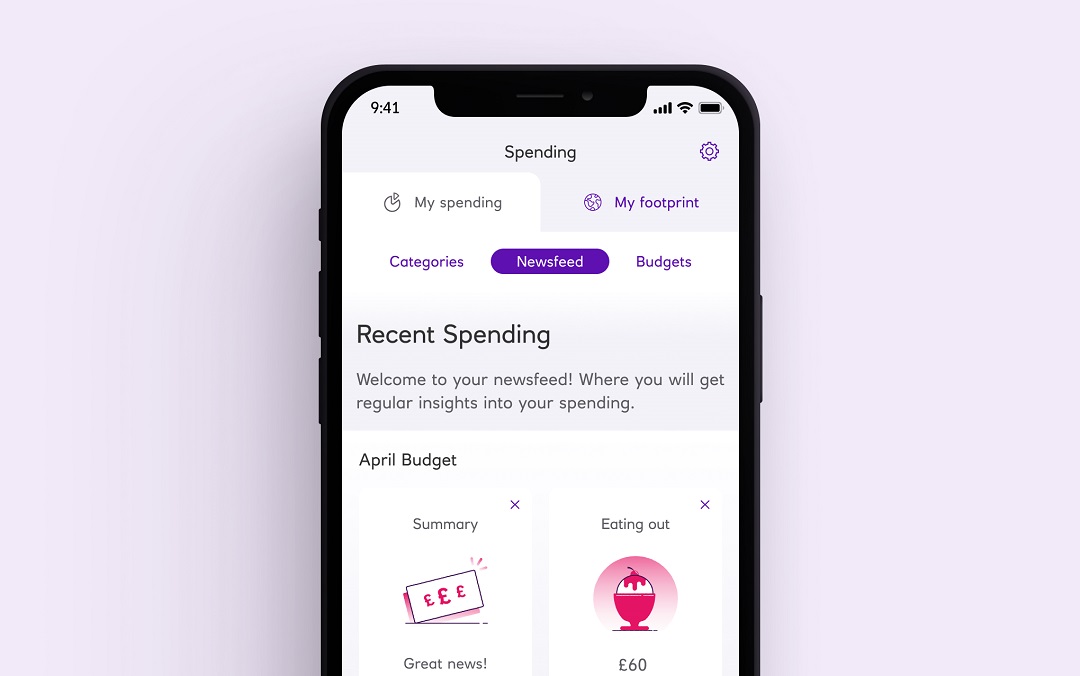

A good habit is to set a monthly budget to plan your spending. It could help you spend less and save more. With the Royal Bank app, you could categorise your current account transactions (e.g. household bills, groceries, eating out, travel, etc) to give you a more detailed picture of where you spend your money and help you to spot opportunities to save each month or donate to charity.

10 ways to help you save

From reviewing your direct debits to switching energy supplier, there are lots of great ways you could save money each month. It might help give you a bit of extra cash to save for a rainy day. Here's some of our top tips.

1. Set a budget

Our App can be used on compatible iOS and Android devices. You'll need a UK or international mobile number in specific countries. Spending Tracker is available to customers aged 16+ who have a Personal or Premier account with us.

3. Set a savings goal

Make a list of short and longer term goals to work towards and watch your savings grow. On average, customers save twice as much when they save towards a goal. Get ahead of the game and set-up a standing order to save a little each month too before all your bills come out. A great strategy.

Our savings goal tool is available to existing customers with an instant access savings account.

4. Save your spare change as you spend

Let your bank do the hard work for you by rounding up your everyday spending to boost your savings. When you pay with your debit card, the amount will be rounded up to the nearest pound, sending the spare change straight into your savings account.

Check out our Round Ups tool to find out how to get started.

Round Ups is available to customers with an eligible current account, an eligible instant access savings account and the Mobile App. Applies to debit card and contactless device payments in sterling only. Mobile App criteria applies.

6. Switch energy supplier

Due to the current situation with increasing wholesale energy prices and a number of energy companies unable to continue trading, it might be more difficult to find a deal when looking to switch your energy supplier at the moment.

8. Ditch that old Direct Debit

With the Royal Bank app take some time to scroll through regular payments, it’s possible you’ll discover at least one Direct Debit or standing order you no longer need. For most, you can cancel these online or over the phone, but it’s worth checking any contracts you may have to avoid any cancellation fee or penalty.

10. Get rewarded for spending

It makes sense to do your research to find the best price but there are also ways you could earn some money back when you spend too.

With a Royal Bank of Scotland Reward bank account you could earn £4 a month back in Rewards for 2 or more Direct Debits – they'll need to be at least £2 each. Plus, get an extra £1 a month back in Rewards for logging into the Royal Bank app once. You could then exchange your Rewards for money, gift cards or donate them to charity.

To apply, you need to be 18+ and a UK resident. To hold this account, you need to pay in £1,250 to an eligible Royal Bank of Scotland account every month.