Everything you need in one place for student life

The award-winning account tailor made for student life

This Student account packs a punch, that's why it's award winning.

Moneyfacts gave our Student Account a 5-star rating for 2025 and YourMoney.com voted NatWest as 'Best everyday current account provider'.

This current account was also given 5 stars by the Defaqto experts in 2024.

How your student overdraft works

- Access £2,000 interest free from year one (£500 in your first term).

- In your third year from October, you could extend it up to £3,250.

- Get handy text alerts to stay on top of your budgeting.

Apply online in just five minutes

Access your funds, fast, once approved

- If your overdraft is approved, it’ll normally be available the next working day. But there might be a few exceptions to be aware of.

Overdrafts are a way of borrowing money and you're responsible for repayments if you decide to use one. If you're unable to repay what is owed, you could impact your credit score, which most lenders use to decide whether they'll lend to you.

Student arranged overdrafts are available to Royal Bank Student current account customers, aged 18 or over. Subject to lending criteria.

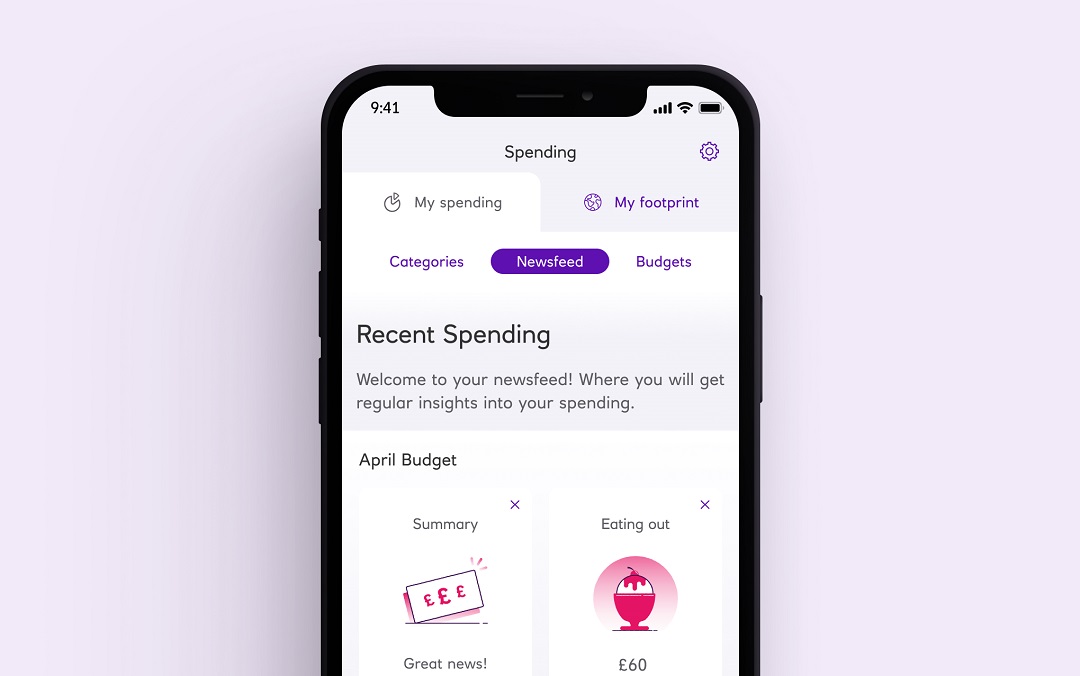

Request money or split a bill

Get paid back without the faff of sharing bank details. Ask someone for money you're owed through the Royal Bank app.

- Send a payment link via your device sharing options.

- Show your QR code to get paid by someone nearby.

- Or use Split the bill to share the cost of a transaction with friends.

Go to 'Payments' then 'Request money' to find these handy features.

Eligibility criteria and limits apply.

Renters Insurance

Insuring your belongings is a wise move, especially during your student years. Take a look at Renters insurance to see if it suits your needs.

Fancy some insider knowledge on student life?

Going to university is a major milestone in anyone’s life. But with so many people to meet and costs to budget for, it’s natural to feel some anxiety. At a time of economic uncertainty, you’ll want to begin your studies with your eyes wide open.

The Royal Bank Student Living Index 2024 gives you the full lowdown on higher education in the UK. From spending to budgeting, student loans to socialising, mental health and beyond, our research can prepare you for both the opportunities and realities of university.

Common questions about our Student account

Your student account graduates with you

Just use your card, digital banking and mobile app as usual. We’ll switch your account from student to graduate automatically.

Prior to the account switch, you should receive an email or letter detailing:

- The changes to your account

- The date of the switch.